Pakistan has stepped boldly into the global spotlight, with Prime Minister Shehbaz Sharif and Field Marshal Asim Munir’s steering the diplomatic ship. President Trump marking a decisive pivot in U.S.-Pakistan relations. Far from ceremonial, recent encounters between leadership of both countries—centred on counterterrorism, trade, and regional stability—reveals a nation no longer reacting to events but shaping them. In an era defined by great-power rivalry, Pakistan is redefining its identity through strategic timing, veiled intent, and calculated risk.

Time is the silent currency of power. When conditions favour you, prolong the moment. When they turn hostile, remain engaged until the window reopens. Isolation or rejection is not an option in the Thucydides Trap, where structural forces compel rising and established powers into confrontation. Pakistan understands this. By engaging Washington at a moment of renewed U.S. interest in countering China and securing critical minerals, Islamabad has transformed vulnerability into leverage.

Sun Tzu’s ancient wisdom—“If you know yourself and know your enemy, you need not fear the result of a hundred battles”—finds modern expression in Pakistan’s actions. The 2019 Balakot response and the May 2025 Operation Bunyan-un-Marsoos were not acts of aggression but demonstrations of restraint and precision. In both cases, Pakistan absorbed pressure, concealed its full strength, and struck only when the cost-benefit tilted decisively in its favour. The May 2025 crisis—triggered by India’s Operation Sindoor following the Pahalgam attack—saw Pakistan down 7 Indian jets, disrupt forward positions, and force a rapid ceasefire, all while maintaining plausible deniability and diplomatic composure.

The Butterfly Effect reminds us that small actions ripple far. A border skirmish can reshape alliances. A diplomatic gesture can shift global perceptions. The Trump recent summit did both. By offering access to Pakistan’s vast rare earth deposits—estimated at over a trillion dollars in value—Islamabad positioned itself as a vital node in the global supply chain, especially as the U.S. seeks alternatives to Chinese dominance. The tariff agreement, the invitation to American firms in agriculture and IT, and Trump’s public praise all amplified Pakistan’s stature. More importantly, they exposed the fragility of India’s regional dominance.

The Thucydides Trap in South Asia

The classic Thucydides Trap pits a rising power (China) against an established one (the United States). But in South Asia, the dynamic is more complex—a regional variant where China challenges India’s subcontinental primacy, and Pakistan serves as both catalyst and counterweight.

India, long the regional hegemon, now faces encirclement through China’s String of Pearls strategy—a network of commercial ports and naval footholds encircling the Indian subcontinent like a necklace of strategic outposts. Key pearls include:

• Gwadar (Pakistan): The crown jewel, developed under CPEC with Chinese funding and now a deep-water hub capable of hosting submarines and aircraft carriers.

• Hambantota (Sri Lanka): Leased to China for 99 years after debt default, now a logistics base.

• Chittagong (Bangladesh): Growing Chinese investment in port upgrades.

• Kyaukphyu (Myanmar): Pipeline access to the Bay of Bengal, bypassing the Malacca Strait.

• Djibouti: China’s first overseas military base, anchoring the western end.

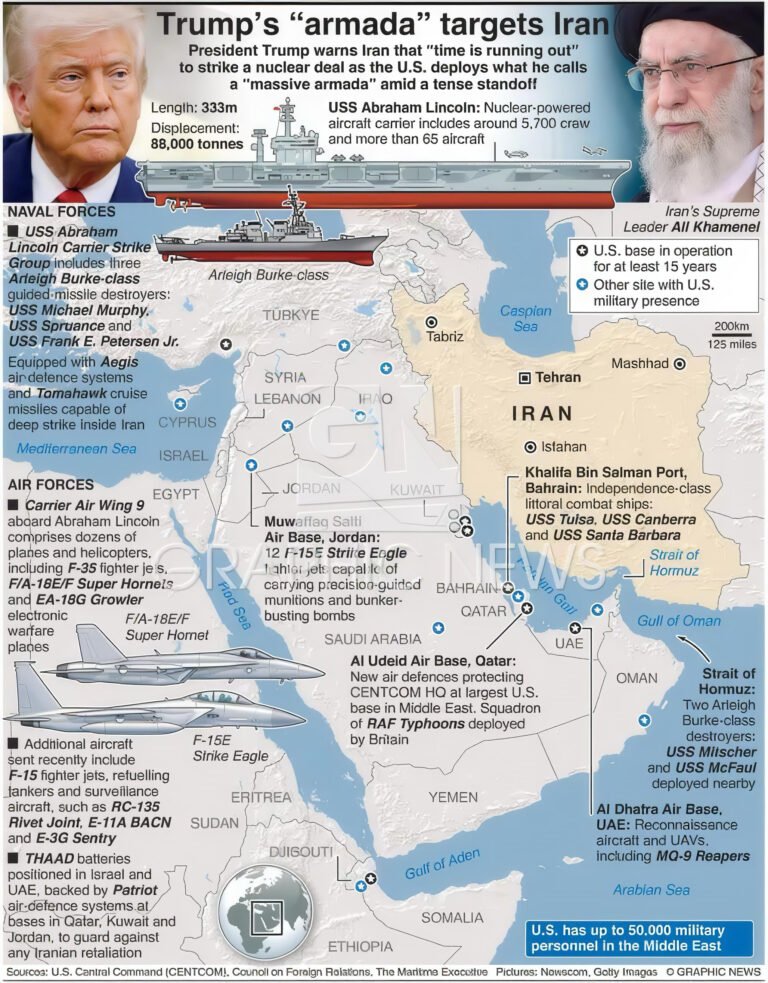

Together, these nodes extend Beijing’s naval reach into the Indian Ocean, threaten India’s sea lanes, and enable rapid power projection. Gwadar, just 400 km from the Strait of Hormuz, gives China a chokehold on 40% of global oil transit. For India, this is not economic competition—it is strategic strangulation.

Pakistan sits at the heart of this design. The China-Pakistan Economic Corridor (CPEC), with over $60 billion invested since 2013, is not just infrastructure; it is the spinal cord of the String of Pearls. Gwadar is its terminus, linking western China to the Arabian Sea and giving Beijing a warm-water port immune to Indian blockade. In return, Pakistan gains economic oxygen, modernised logistics, and a security blanket against Indian aggression.

The 2020 Galwan clash and persistent Ladakh tensions are symptoms of a deeper anxiety: India fears being overtaken not just militarily but economically and diplomatically. China’s incremental encroachments—“salami-slicing”—test Indian resolve without triggering full war.

India does not sit idle. Its response include a deliberate, multi-layered strategy to target China’s maritime lifelines, and neutralise Pakistan’s leverage. It operates on four fronts, with the Quad serving as the strategic backbone and operational multiplier.

Strategic Port Alliances is pivot of Indian strategy

enabled by Quad logistics and intelligence sharing:

◦ Chabahar (Iran): India’s $500 million investment bypasses Pakistan, links to Afghanistan and Central Asia, and threatens Gwadar’s viability.

◦ Duqm (Oman): Access to a key Arabian Sea port, with Indian listening posts and refuelling rights.

◦ Assumption Island (Seychelles): Naval base development to dominate the western Indian Ocean.

◦ Agaléga (Mauritius): Airstrip and jetty for maritime surveillance.

◦ Sabang (Indonesia): Deep-water access near the Malacca Strait.

2 Quad and Maritime Coalitions

The Quad is the glue that turns ports into power projection platforms.

◦ Malabar Exercises: Now annual, multi-domain (air, sea, cyber), and increasingly live-fire. The 2025 iteration off Sri Lanka practised blockade scenarios targeting Gwadar-Hambantota supply lines.

◦ Quad Maritime Security Initiative (2024): Real-time satellite tracking of Chinese vessels, shared P-8I and MQ-4C Triton data, and joint anti-submarine patrols.

◦ Critical Minerals Task Force (2025 Summit, New Delhi): A direct counter to Pakistan’s rare earth diplomacy. The Quad is mapping alternative supply chains—Australia (lithium), Japan (processing), India (refining), and the U.S. (investment)—to bypass Chinese and Pakistani reserves.

◦ Quad Satellite Constellation: Japan’s QZSS + India’s NavIC + U.S. GPS + Australia’s ground stations = domain awareness dominance over the entire Indian Ocean, rendering String of Pearls movements transparent.

3 Economic and Diplomatic Leverage

India uses debt diplomacy in reverse, with Quad backing:

◦ Sri Lanka: $4 billion in aid post-2022 crisis, plus Japanese debt restructuring to counter Chinese influence.

◦ Maldives: Expelling Chinese “research” vessels, secured by U.S. Millennium Challenge grants.

◦ Bangladesh: $8 billion in lines of credit, with Australian rare-earth exploration deals to pull Dhaka from Beijing’s orbit.

4 Military Posture and Asymmetry

◦ Andaman & Nicobar Command: Upgraded to a tri-service theatre with P-8I Poseidon aircraft, BrahMos missiles, and submarine pens—positioned to sever the Malacca-to-Gwadar route. Quad ISR feeds now guide every patrol.

◦ Operation Sindoor (May 2025): Despite setbacks, it signalled India’s willingness to strike deep into Pakistan, forcing Islamabad into a defensive crouch—with U.S. satellite warnings preventing Pakistani nuclear escalation.

The Quad is not just a talk shop; it is the operational nervous system of India’s strategy. Without it, India’s ports remain isolated outposts. With it, they become interoperable chokepoints in a networked containment grid.

Pakistan’s Judo in the Trap

Pakistan does not seek war but uses the spectre of instability to extract concessions. The May 2025 crisis was a case study: India overreached, Pakistan responded proportionately, and the U.S.—eager to prevent escalation near nuclear thresholds—stepped in to mediate. Trump’s role as “peacemaker” was less about altruism than realpolitik: a stable Pakistan serves American interests in Afghanistan, counters Chinese influence, and secures access to critical resources.

This is the South Asian Thucydides Trap in action: not a binary clash, but a triangular struggle where fear, honour, and interest collide. India fears encirclement. China seeks dominance without full-scale war. Pakistan exploits the gap between them. And the United States, wary of both Beijing and an overconfident New Delhi, finds value in a balanced, engaged Islamabad.

A New Identity Takes Shape

Pakistan is no longer the crisis-ridden state of the past. It has unveiled a confident, pragmatic face—one that negotiates with superpowers, deters regional rivals, and positions itself at the intersection of energy, minerals, and geopolitics. The White House visit was not the endpoint but the opening act of a broader strategy.

The next moves will define the decade. Will Pakistan deepen its minerals partnership with the U.S., using American capital to diversify away from CPEC dependency? Or will it launch a CPEC 2.0, daring India to respond and risk springing the trap on itself? Either path requires the same mastery: timing, deception, and an unflinching understanding of the structural forces at play.

In the arena of nations, as in war and business, those who control the rhythm control the outcome. Pakistan has found its beat.