Dawn breaks over the Pacific, and the world’s wealth recalibrates in real time. On trading floors from Tokyo to Toronto, screens flicker with the same verdict: the top ten largest companies by market capitalisation are either American-born or cradled in the shadow of American power. Their combined $26 trillion valuation—roughly one-quarter of global GDP—does not merely reflect wealth; it is the new currency of influence, traded in code, secured by carriers, and denominated in dollars.

At the summit stands NVIDIA, a California chip designer whose $5.049 trillion crown now eclipses the GDP of every nation save the United States and China. Its shares close at $207.38, up 3.16%—a bold green arrow that pulses through pension funds in Oslo and data centres in Singapore. Once a niche semiconductor firm, NVIDIA has become the nerve centre of the AI economy, exporting not just GPUs but the infrastructure of tomorrow. The world pays in dependency.

A heartbeat behind, Apple guards second place at $4.013 trillion. The bitten black apple gleams on $270.42 shares, up 0.53%. From Cupertino’s glass ring, profit streams home while iPhones assemble in Shenzhen. The device in your pocket is global; the patents and power are not.

Microsoft follows at $4.006 trillion, its 539.04 shares dipping 0.56% in a rare red tick. Yet even a stutter does not dim its reach: Azure clouds hum in Iowa, but the rules of enterprise are written in Redmond.

Alphabet, Google’s parent, claims fourth with $3.299 trillion. The multicoloured “G” dances on $273.34 shares, up 1.83%. Mountain View’s algorithms do not just index the internet—they are the internet’s constitution.

Amazon rounds out the digital oligarchy at $2.446 trillion. Its orange smile-arrow logo accompanies 229.38 shares, up a whisper of 0.05%. Seattle’s warehouses span continents, but the margins flow west.

Together, these four Bay Area and Pacific Northwest titans—Apple, Microsoft, Alphabet, and Amazon—command $14 trillion, more than the GDPs of Japan, Germany, and India combined. Their campuses lie within a 50-mile radius of innovation, yet their platforms dictate how humanity communicates, computes, and consumes.

Meta Platforms (sixth, $1.879 trillion) extends the streak. The blue infinity loop marks 748.05 shares, down 0.45%. Menlo Park’s feeds shape discourse from Manila to Madrid.

Broadcom (seventh, $1.789 trillion) keeps the silicon flowing at $379.02 per share, up 1.62%. Its chips are quiet, but without them, none of the above would speak.

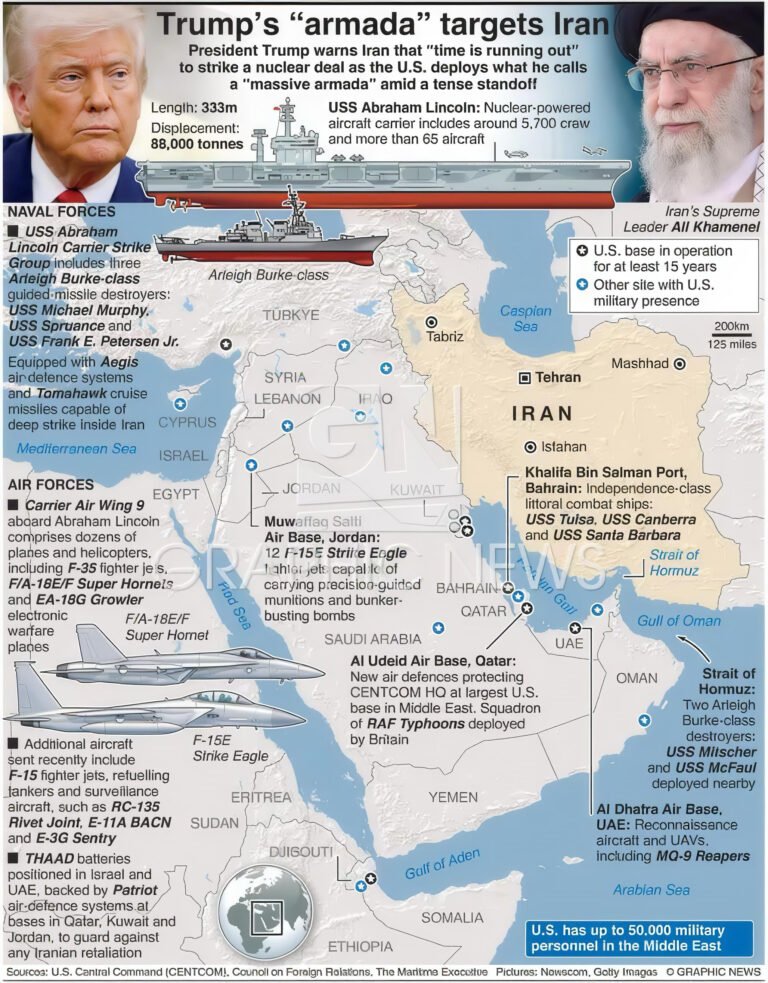

The pattern fractures—briefly—in eighth place. Saudi Aramco, the lone non-U.S. headquarters, rises at $1.671 trillion. Its green sunburst logo crowns shares at $6.91, up 0.15%. Born in 1933 as the Arabian American Oil Company through Standard Oil of California (now Chevron), Aramco’s origins are as American as its current petrodollar recycling. U.S. carriers patrol the Gulf; Texas refineries process its crude. The desert giant is a historical vassal in a ledger of primacy.

TSMC, ninth at $1.584 trillion, forges the silicon that keeps NVIDIA and Apple aloft. Its blue-and-silver wafer logo marks $305.41 shares, up 1.29%. Taiwan’s foundries operate under U.S. export controls and naval deterrence in the Strait. The chips are Taiwanese; the security is American.

Tesla closes the elite circle at $1.532 trillion. The silver “T” grille gleams on $460.86 shares, up 0.07%. The only pure-play electric vehicle maker in the top ten scales on U.S. innovation, subsidies, and the dollar’s reserve gravity.

Peering just beyond, Berkshire Hathaway lingers in eleventh at $1.028 trillion. Warren Buffett’s black “BH” logo accompanies 475.92 shares, down 1.15%. Omaha’s conglomerate is the old guard watching the new titans ascend.

Nine of the top ten are U.S.-headquartered: NVIDIA, Apple, Microsoft, Alphabet, Amazon, Meta, Broadcom, Tesla, and Berkshire Hathaway. The tenth, Saudi Aramco, carries American DNA in its founding charter. TSMC’s independence is underwritten by the Seventh Fleet.

This is not a list; it is a mirror. When NVIDIA surges, sovereign wealth in Abu Dhabi rises. When Apple innovates, supply chains in Vietnam pivot. The green arrows and red ticks are not mere price signals—they are the pulse of Pax Americana, measured in trillions, enforced by code, and dreamed in Silicon Valley.

The world’s wealth is no longer counted in oil barrels or gold reserves. It is traded in Manhattan, stored in Virginia, and etched in the ledger of ten titans—nine American, one vassal—whose dominance is as inevitable as the sunrise over the Pacific.

#Top10Titans #PaxAmericana #NVIDIACrown #CodeIsTheNewOil #DollarDenominated

Hey there! Do you know if they make any plugins to assist with Search Engine Optimization? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good results. If you know of any please share. Thank you!