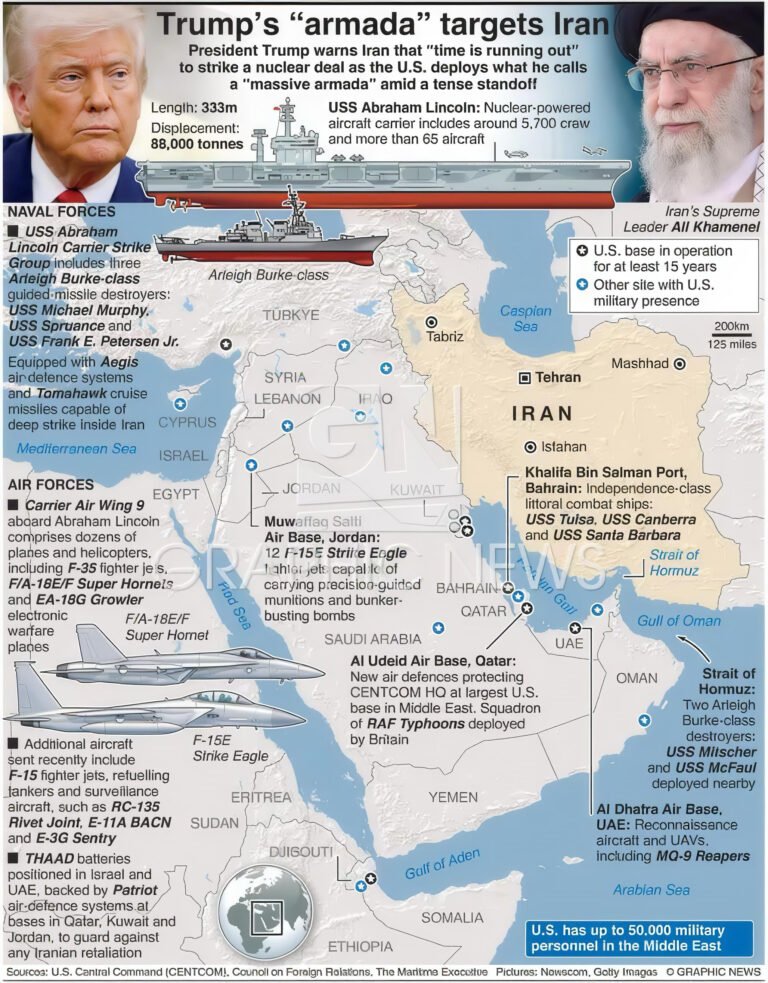

The events of early 2026 could disrupt the global economy as tensions between major powers escalate. Some individuals think that the U.S. military’s dramatic involvement in Venezuela, which led to the capture of Nicolás Maduro and airstrikes on Caracas, was a brave move against drug trafficking. But this move looks like part of a bigger plot to stop China from getting cheap electricity. Venezuela has the most proven crude oil reserves in the world, with roughly 303 billion barrels. China has always bought a lot of Venezuela’s goods, between 60% and 90%. This action could start a chain reaction of resource bargaining, supply problems, and market instability. Some people may be overstating the risks of the market fully collapsing and affecting “98% of people,” but they are real: increased inflation, stock market collapses, and currency instability might be terrible for both investors and countries. Let’s look more closely at how these developments are happening and what they could mean for 2026. The Venezuela Flashpoint: There’s More to It Than You Think The U.S. attacked Venezuela on January 3, 2026, by bombing military targets in Caracas and immediately holding Maduro and his wife hostage. The declared motive for the operation was to halt drug trafficking, and Maduro is facing federal narco-terrorism charges in the U.S. But the time and place suggest there are deeper causes. Opposition sources suggest that Maduro’s resignation was planned and not a surprise fall. Also, the strikes happened at the same time when Chinese officials were coming to Venezuela for important talks. There was a reason for this, and it was a clear message to Beijing.Venezuela’s oil is more than just a good; it’s a strategic resource. The country is responsible for about 4% of China’s total oil imports, although its heavy crude is inexpensive and particularly significant for some refineries. Washington is essentially tightening the noose on one of China’s main suppliers by giving the U.S. more control over Venezuelan oil assets following the intervention. This move shows that China has $19 billion in overdue loans tied to Venezuelan oil. This could cause a shortfall of heavy sour crude and make Beijing hunt for more costly alternatives. People on X are discussing about the political side of things, arguing that Maduro’s government isn’t the only one that suffers; Russia, Iran, and China’s dominance in the Western Hemisphere also suffers. One post suggests that these nations used Venezuela as a proxy, which might have provided them military sites close to the U.S. Some people have brought up the Monroe Doctrine, which backs up the assumption that this is more about controlling the hemisphere than merely aiding people or battling drugs.Echoes of 2025: The Iran Parallel and Systematic Denial This has happened before. In 2025, President Trump talked of “maximum pressure” sanctions on Iran, which damaged the country’s oil exports. China buys 85–90% of Iran’s oil, making it the country’s biggest consumer. These actions, which included punishing ships and networks that enabled Iranian oil access to China, lowered flows by a lot at times, going from 1.6 million barrels per day in September 2024 to as low as 740,000 bpd later.To diminish China’s economic might, the objective is clear: cut off its access to cheap, reliable electricity. Venezuela and Iran together supply China roughly 30 to 35 percent of its oil. This denial approach has nothing to do with “stealing oil” from Venezuela; the US doesn’t buy much Venezuelan petroleum. Instead, it’s about employing energy as a weapon in the fight between great forces. The U.S. intends to weaken China’s strategic footholds, raise energy prices for its economy, and maybe even bring global oil pricing power back to the petrodollar system by controlling or influencing these supplies. China’s response: the Silver Card and negotiating for resourcesBeijing’s answer has been cool but unequivocal. China declared that what the U.S. did was a violation of its sovereignty and sought for punishment. China modified the laws for sending silver to other countries on January 1, 2026. Along with tungsten and antimony, it is currently seen as a key resource.This isn’t a full prohibition; 44 enterprises can still export items in 2026 and 2027. But it makes it difficult to trade 60–70% of the world’s refined silver, which China controls. Silver, which is crucial for solar panels, electronics, and industry, might be used as a bargaining tool if talks regarding Venezuelan oil don’t go well. This is similar to what China did with rare earths, where they used export limits to push back against U.S. pressure. If things go worse, we could see limits that go back and forth, which would make supply chain difficulties worse, like they did in the first quarter of 2025. What this means for the market: Not a certain collapse, but a lot of ups and downs The idea of a “global market collapse” in 2026, when “98% of people will lose everything,” is alarming, but the risks are genuine. Most predictions paint a better picture: By 2026, the economy of the world is predicted to grow by 2.8% to 3%. Tariffs will slow down the U.S. economy to 0.4 to 1.1%, but it won’t go into a recession. After three years of double-digit growth, inflation is expected to slow down, and stock markets may not rise as much.That being said, changes in the world could change this.If Venezuela’s oil supply difficulties get worse, prices might go up, which would trigger inflation anew.Emerging markets, which are already weak, could be the first to go down, which would cause stocks all over the world to go down.The dollar might go up quickly, which would weaken EM currencies. Bitcoin and other cryptocurrencies might have trouble with liquidity at first until they start to work as hedges.There is a good probability that asset markets will be unstable, especially if China responds by making it harder to get resources. Different stakeholders’ opinions reflect bias: Some sources in the West focus on U.S. security goals, while others label it “neo-imperialism for oil.” Chinese people recognize it as economic warfare, but Venezuelans are still divided. How to Stay Alive in 2026: Positioning for the Unknown This isn’t a “normal cycle”; it’s an increase in conflict between major nations over energy. Investors should minimize their risks by putting their money into hedges like commodities or assets that are safe from inflation. Watch oil futures, silver prices, and EM debt for signals of things to come. Currently, a big collapse is unlikely, but ignoring these tensions might be costly. As the U.S. and China get more competitive, 2026 could be a test of how solid the world’s markets are. Be ready, but know that there are both real and fake dangers.