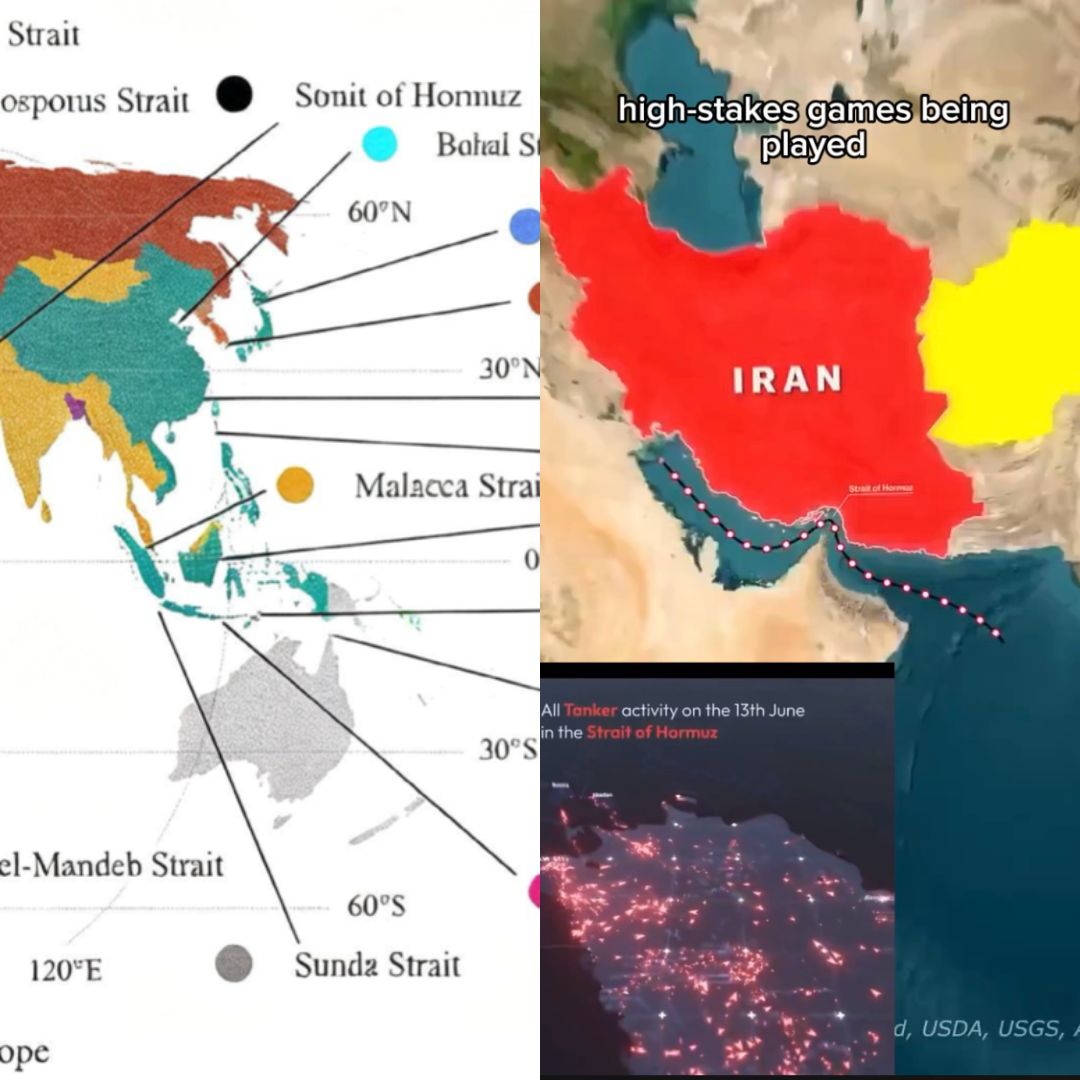

The emerging crisis in straits of Hormuz is not in isolation. It is consistent with previous conflicts in middle east and Russia-Ukraine war and Venezuela. The emerging conflict at world’s most important choke point is pivotal convergence of three intervonnected conflicts

1. A US-Iran Deterrence Battle:

A high-risk game of brinkmanship where Iran uses the threat of disrupting the strait as an asymmetric weapon, while the US responds with a massive naval show of force. The volatile mix of US political cycles and the lurking “wild card” of Israel creates a high risk of miscalculation and rapid escalation.

2. The US-China Great Power Competition: China executes a calculated “balancing act,” supporting Iran economically and diplomatically to gain leverage and challenge US hegemony, while carefully avoiding direct military entanglement to protect its own energy interests. It positions itself as a neutral mediator, seeking to capitalize on US involvement to enhance its global diplomatic status.

3. Global Economic Vulnerability: The strait’s role as a chokepoint for 20% of the world’s oil means any disruption would trigger an immediate oil price shock, forcing a terrible choice on central banks between inflation and recession, and stressing international alliances.

The outcome is a stress test for the world order:

· If the US deters Iran, it reaffirms its security dominance at a high cost.

· If Iran succeeds in causing disruption, it deals a major blow to US credibility and empowers rivals.

· The most likely result is continued tense brinkmanship that falls short of all-out war, but which accelerates global shifts: empowering China diplomatically, forcing a frantic search for energy alternatives, and pushing Middle Eastern and allied nations to hedge their bets in an increasingly multipolar world.

Let us analyze minutely

1. The US-Iran Dynamic: Brinkmanship with Higher Stakes

· Credibility vs. Capability: Iran’s threat is a classic asymmetric weapon. A full closure is immensely difficult militarily and would be an act of war, but even harassment, mining, or limited attacks can achieve the desired effect—spiking insurance costs, creating panic in oil markets, and demonstrating capability. The US naval buildup is a textbook show of force to deter this, but it also raises the risk of a tactical incident (e.g., a miscalculation with Iranian fast-attack craft) spiraling.

· Strategic Diffidence Meets Electoral Calculus: The analysis notes US “strategic diffidence.” A 2026 timeline, potentially during a US presidential election season or new administration, adds a volatile political layer. A president (Trump or otherwise) would face immense pressure to respond decisively to any disruption, making de-escalation politically tricky. Iran may be timing its signals to test resolve during a perceived period of US political transition or distraction.

· The Israeli Factor: While not heavily detailed in this segment, the lurking presence of Israel and its conflict with Iran is the “wild card.” Any major US-Iran clash in the Strait could instantly trigger a parallel and possibly larger Iranian response against Israel, exploding the crisis beyond a maritime conflict.

2. China’s Calculated “Balancing Act”: A Masterclass in Strategic Ambiguity

China’s position is the most nuanced and reveals its evolving global playbook:

· The “Three Nos” Strategy: China is signaling: No to US unilateralism, No to disrupted energy flows, and No to direct military entanglement. This allows Beijing to be all things to all parties: a partner to Iran, a responsible stakeholder to global markets, and a critic of US hegemony.

· Leverage Without Liability: By providing Iran with “intelligence, logistical, financial, military, and technological support,” China gives Tehran a lifeline, ensuring the regime’s survival and deepening its dependency. This buys China enormous leverage (“We are your economic and diplomatic shield”). However, by explicitly ruling out direct military support, China avoids being dragged into a war that would devastate its primary interest—stable, affordable oil flows.

· The Mediator’s Advantage: China positions itself as the indispensable mediator, as seen in the Saudi-Iran deal. Even if mediation fails now, the attempt itself elevates China’s diplomatic status at the expense of the US, which is seen as a party to the conflict rather than a neutral broker.

· The Hedged Bet: If the Strait closes and oil prices skyrocket, China suffers economically but gains geopolitically. The US and its allies (Japan, Korea, Europe) would feel more acute pain, potentially fracturing the Western-led order. China’s long-term contracts and relationships might give it preferential access to remaining supplies, and the crisis would accelerate its push for alternative routes (CPEC through Pakistan, pipelines from Russia) reducing Hormuz dependency.

3. The Global Systemic Impact: More Than Just an Oil Spike

· Inflation & Global Recession: A sustained price spike would force central banks to choose between fighting inflation with higher rates (crushing growth) or tolerating inflation (eroding stability). This could trigger a global recession.

· The “Suez Moment” for Energy Security: A prolonged crisis would be the strongest possible impetus for energy diversification: a massive sprint for renewables, nuclear, and a boon for non-Middle Eastern producers (US shale, Guyana, Brazil, Venezuela if sanctions shift). It would permanently alter the geopolitical weight of the Gulf.

· Alliance Stress Tests: NATO and US alliances in Asia would be stressed. Would European allies fully support US military action? Would Japan and South Korea seek urgent assurances or even independent security arrangements? This fragmentation is a key Chinese and Russian objective.

4. The “Multi-Alignment” of Regional Powers: The True Winners & Losers

· Gulf Arab States (Saudi Arabia, UAE): They are caught in a nightmare. Their wealth and exports are held hostage. They rely on the US for security but on China for economic future-proofing. They will quietly pressure the US to avoid war while begging China to restrain Iran. Their limited pipeline alternatives are a safety valve, but not a solution.

· Russia: A silent beneficiary. Higher oil prices fill its coffers. A US-Iran conflict distracts the West and burns US military resources. It aligns with China’s anti-US narrative, strengthening their strategic partnership.

Conclusion: A Pivotal Moment

This is not just another crisis in the Gulf. It is a pivotal stress test for a transitioning world order.

· If the US successfully deters Iran and keeps the Strait open, it re-asserts its security primacy but at high cost, and the world remains on the old path of US-guaranteed energy flows.

· If Iran successfully disrupts flows and the US response is seen as ineffective, it would be a massive blow to US credibility, a boost for Iran and its “Axis of Resistance,” and a clear signal that American hegemony is receding. China would step into the diplomatic vacuum as the new essential power.

· If it escalates to a major US-Iran war, it would be a catastrophic regional war with global economic depression as a side effect, benefiting no major power directly but creating a chaotic vacuum.

The most likely outcome, as suggested, is continued “competitive coexistence”—tense brinkmanship that falls just short of catastrophic war, with China incrementally gaining diplomatic and economic ground while the US bears the cost and risk of military deterrence. The real insight is that the rivalry is no longer just about the US and China; it’s about how Middle Eastern powers skillfully navigate between them to secure their own survival and advantage in an increasingly multipolar world.