Is the Dollar’s Throne Crumbling Overnight?

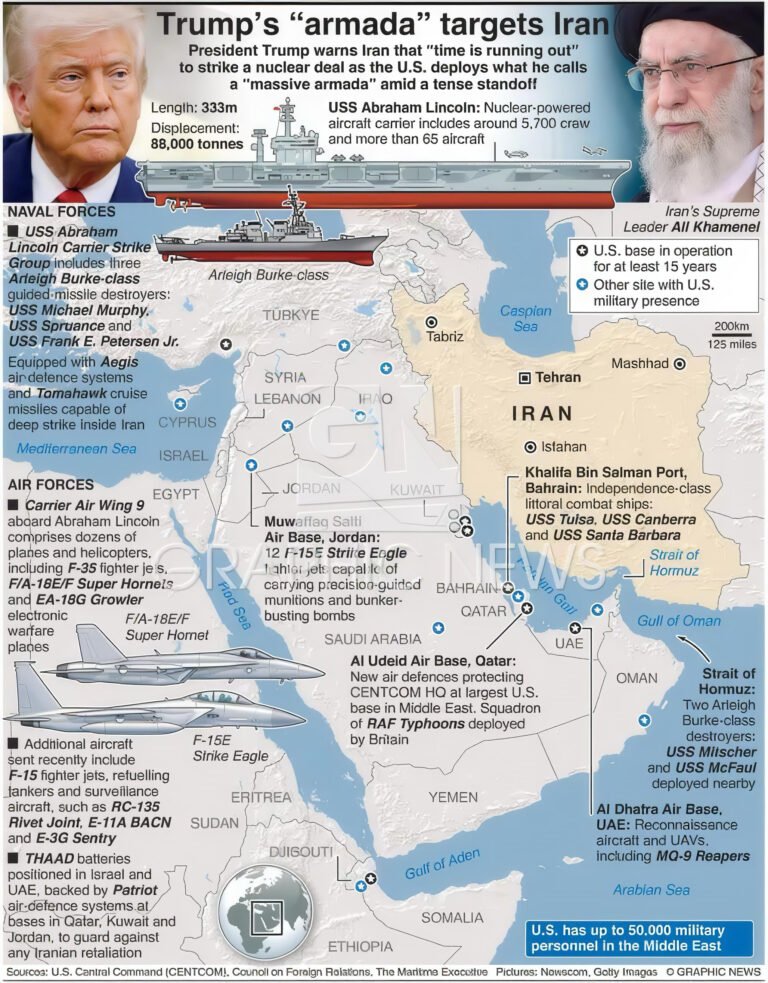

In the high-stakes chessboard of global politics, every move is measured with the precision of a bomb-disposal expert. Right now, the world is locked in a silent, multi-front war over the dollar’s monopoly, the petrodollar empire, rare-earth minerals, semiconductor chips, data dominance, and energy supremacy. On the military front, the old arsenal of bullets and bombs has yielded to sleek fighter jets, beyond-visual-range missiles, stealth radars—and above all, drones, the game-changing assassins of modern warfare.

Had the United States not frozen Russia’s $330 billion in 2022, the planet might not have woken up so abruptly to the dollar’s fragility. That single act sent shockwaves through central banks worldwide: “Tomorrow, it could be us.”

Today, gold has eclipsed U.S. Treasury bonds in central bank vaults. By 2024, they hold ~36,000 tonnes—nearly one-fifth of all gold ever mined. Meanwhile, foreign holdings of U.S. Treasuries hover near $8 trillion, but the ratio is shrinking fast. The World Gold Council reports relentless buying: 1,082 tonnes in 2022, 1,037 in 2023, and ~800 tonnes in just the first nine months of 2024. With annual mining capped at 3,000–3,500 tonnes, demand is outpacing supply like never before.

The Five Horsemen of De-Dollarisation

1. 2008 Financial Meltdown The world learnt that blind faith in the dollar is a gamble. Quantitative easing slashed its value like a hot knife through butter.

2. Russia’s Frozen Reserves (2022) A $330 billion warning shot. Central bankers now sleep with one eye open.

3. The Rise of BRICS+ China, India, Brazil, Russia, and Saudi Arabia are weaving mBridge and CIPS—alternative financial arteries bypassing SWIFT.

4. Nixon Shock Aftermath (1971–Present) The dollar has lost 95% of its purchasing power. Gold, the ancient anchor, is reclaiming its crown.

5. Geopolitical Realignment America’s unipolar moment fades. New power blocs rise in Beijing, Moscow, and the Middle East.

The verdict? De-dollarisation is underway—but it’s a glacier, not a lightning bolt.

Will America Surrender Without a Fight?

No

* It’s sanctioning rival payment networks.

* Racing to launch a digital dollar (CBDC).

* Pressuring Saudi Arabia and India to cling to petrodollars.

* Allegedly manipulating gold prices on COMEX.

* Fortifying the dollar with new trade pacts like IPEF and USMCA.

The empire strikes back—but the cracks are widening.

The Petrodollar: A 1970s Pact Under Siege

Born from a secret handshake between Washington and Riyadh, the petrodollar decreed all oil trades in dollars. Oil giants recycled profits into U.S. Treasuries, creating an unbreakable loop of demand and debt.

But the loop is fraying.

* China’s “Petroyuan” launched in 2018 on the Shanghai INE—gold-convertible futures to lure trust.

* Gulf states now sell oil in yuan while hedging security with the U.S.

* BRICS nations trade in rupees, reais, and rubles.

* Foreign Treasury holdings are shrinking—the foundation trembles.

The Multipolar Money Horizon

By 2030, imagine a world where:

* Dollar: ~40% of reserves

* Yuan: ~20%

* Euro, gold, and crypto: carving up the rest

A BRICS gold-backed unit? Possible by 2025–2030—but still in the talking phase. Bitcoin as digital gold? Central banks may allocate 1–5%.

The Great Reset 2030 isn’t a conspiracy—it’s the World Economic Forum’s open playbook: CBDCs, carbon taxes, green finance, and digital IDs.

The dollar won’t vanish. But its monopoly? That’s already history in the making.

The throne isn’t collapsing—it’s being shared. And the world is learning: no empire rules forever.