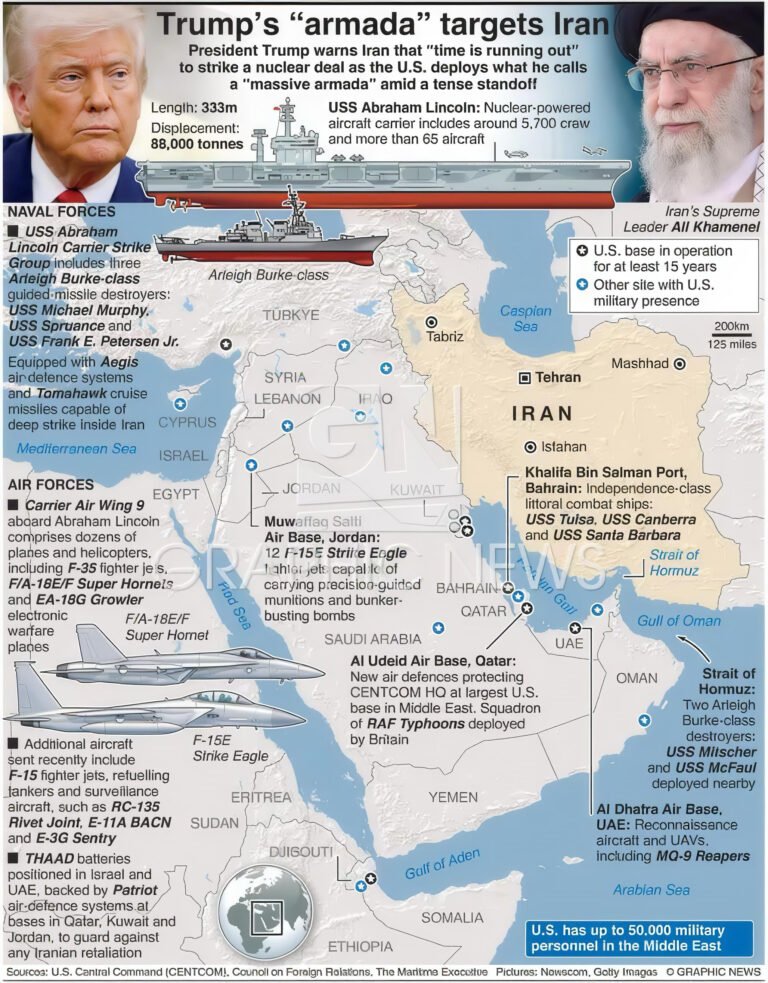

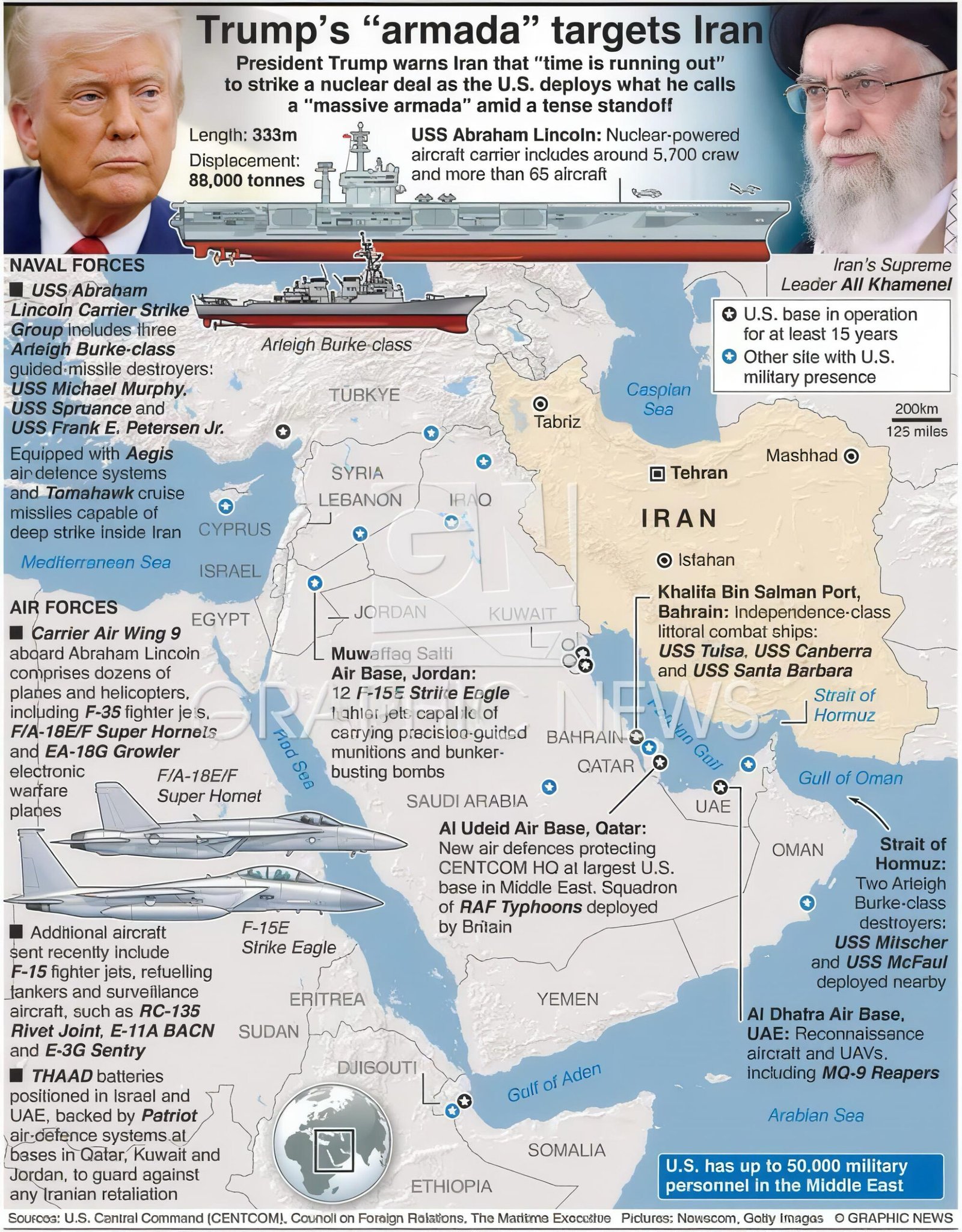

US’s massive military built up in and around persian gulf is not in isolation.

It is a classic great-power competition in which US leverages local dominance in a secondary theater to contain a disruptive middle power (Iran), while Russia spoils for distraction and China hedges for stability and leverage. President Donald Trump warned Iran on Thursday that it must make a deal over its nuclear program or “really bad things” will happen, and set a deadline of 10 to 15 days, drawing a threat from Tehran to retaliate against U.S. bases in the region if attacked. Analysts say, the 10–12 day clock is real; the deeper timer measures how much US bandwidth is drained before the Indo-Pacific priority reasserts itself.

Core Strategic Map

- US: Force zero/near-zero enrichment + missile/proxy curbs via deal or limited strike → free resources for China contest. This is a clear and concise strategic framing which means contain peripheral threats (Iran/missiles) to consolidate resources for the great-power competition with China

- Russia aims to keep the Gulf hot: bleed the US budget and increase own revenue through its oil sale

- China: Contained crisis → Iranian regime intact, oil flowing (cheaply), US distracted. China is playing “Goldilocks” Strategy. Crisis not too hot, not too cold: Iran survives, oil stays cheap, America bleeds focus.

Deep Dive 1: Russian Naval Specifics

Russian-Iranian drills launched exactly on 19 February in Gulf of Oman / northern Indian Ocean / Hormuz approaches. Assets: Russian Steregushchiy-class corvette Stoikiy + IRGCN frigates, fast-attack craft, submarines. Framed as “Maritime Security Belt” (possible future China phase). Effect: pins US carriers/jets in Gulf, adds $2–3/bbl risk premium to Urals, gives Iran cover for asset repositioning. It means on 19 Feb Russia-Iran drills in Gulf of Oman pin US assets, lift Urals price, shield Iran moves—China may join later.

Deep Dive 2: China’s Quiet Diplomacy

Public restraint (“dialogue only”) masks intense back-channel work: closed-door sessions in Tehran/Muscat pre-Geneva, activation of 2023 Saudi-Iran channel to urge GCC restraint, and explicit Iran coverage in 18 Feb Trump-Xi call. Red lines: no regime collapse, no full Hormuz shutdown (China took ~1.2 mbpd discounted Iranian crude in 2025). Preferred outcome: face-saving interim freeze until after US mid-terms / April Trump-Xi summit.

Deep Dive 3: Oil-Market Scenarios

Brent crude is currently hovering around a six-month high of $71.80 to $72.40 a barrel, with about $3.50 of that price being a direct risk premium from recent US statements. Looking ahead, the outlook for oil prices—and the subsequent impact on Pakistan—depends on how the current situation unfolds.

The most likely scenario, with a 55% probability, is a period of diplomatic crawling or a minor deal. In this case, we would see Brent peak at a manageable $75 to $78. For Pakistan, this translates to a modest 4-6% increase in the Consumer Price Index (CPI) and a current account deficit (CAD) that, while under pressure, remains manageable.

If the situation escalates to limited US strikes that avoid hitting Hormuz—a 30% probability—oil could jump to between $85 and $95. This would be a serious blow to Pakistan, increasing its annual fuel and import bill by an estimated $1.5 to $2.5 billion, a 12-18% hike.

Should Iran retaliate asymmetrically using proxies and conducting limited harassment in the Strait, which we put at a 12% chance, prices would spike to between $100 and $120. Pakistan would then face severe inflation, adding 2 to 4 percentage points to the current rate, a depreciating rupee, and a real risk of fuel rationing.

The worst-case, though least likely at under 3%, is a full closure of the Strait of Hormuz lasting one to three weeks. This would send Brent soaring past $130 to a potential peak of $160, triggering a national emergency in Pakistan. The import bill would balloon by an extra $4 to $6 billion or more, leading to industrial shutdowns and a collapse in exports.

Deep Dive 4: Pakistan’s Exposure and Strategic Calculus

For Pakistan, the current crisis isn’t an abstract geopolitical contest—it’s a direct hit to its economic vitals. As a frontline state bordering both Iran and the Gulf, Pakistan is uniquely exposed. It imports the vast majority of its energy, spending roughly $9 to $11 billion annually on petroleum. The math is brutal: every sustained $10 increase in the price of a barrel of oil adds another $1.2 to $2 billion to that bill and shaves 1.5 to 2 points off economic growth by fueling inflation.

That inflation isn’t just a number; it translates immediately to higher transport costs, more expensive electricity, and crippling input costs for industries. If the Strait of Hormuz were disrupted, the situation would go from bad to catastrophic. Freight and insurance costs would skyrocket, making raw material imports unviable and wiping out the competitiveness of Pakistani textiles in markets like the EU. The current account deficit would balloon, and the rupee would come under intense pressure, with the country’s strategic reserves drained in a matter of weeks.

Beyond the balance sheet, the security calculus is equally dire. Pakistan shares a 900-kilometer porous border with Iran, a corridor vulnerable to refugee flows, militant spillover, and Baloch insurgent groups who could exploit the chaos. Attacks on the China-Pakistan Economic Corridor (CPEC) in Balochistan have already risen by 25% this year; any regional turmoil would only intensify the targeting of Gwadar port and the Chinese personnel there. Gwadar itself is a paradox: it is dangerously exposed to fallout from a Hormuz closure, yet it is also being quietly explored as a potential bypass—a pipeline alternative from Saudi Arabia or the UAE that could become Pakistan’s lifeline in a contingency.

Diplomatic & Strategic Calculus

Pakistan must thread an even finer needle than usual:

- US track: Maintain/improve security ties (F-16 sustainment, possible sanctions relief on missile entities), position Islamabad as quiet mediator or back-channel facilitator — Trump’s style often rewards pragmatic partners.

- China track: Protect and accelerate CPEC Phase II (energy, industrial zones, tech) — Beijing is doubling down despite attacks, viewing Gwadar as irreplaceable Indian Ocean foothold.

- Gulf track: Saudi/UAE remain largest financiers and oil suppliers; any rupture here is existential.

- Iran track: Keep border stable and access discounted fuel/routes; avoid entanglement in nuclear/missile issues while quietly hedging.

Net Assessment for Islamabad

A quick US-Iran deal is best-case (stable oil, no spillover). Limited strikes are tolerable if contained. Full escalation is nightmare scenario — higher than 2022 energy crisis pain. Opportunity window: leverage geography to extract economic relief (cheaper Gulf oil deals, IMF breathing room, CPEC acceleration) and diplomatic space (Trump’s “deal-maker” approach often creates side-benefits for useful partners).

Bottom-Line Great-Power Scorecard (Updated)

- US holds initiative but pays opportunity cost.

- Russia wins cheap distraction.

- China hedges optimally.

- Pakistan — highest relative vulnerability but also asymmetric upside if it plays the multi-alignment game skillfully.

From Pakistan’s perspective, the next 10–12 days will test every pillar of national security and economic policy. The military and Petroleum Division are already war-gaming supply alternatives; the Foreign Office is quietly activating all channels. A $100+ oil spike would be the single largest external shock to Pakistan’s 2026 outlook — bigger than any single bilateral crisis.